| |

| |

| |

| |

| |

| Axios Generate |

| By Ben Geman and Andrew Freedman · Sep 27, 2024 |

| ☕ Good morning. We start with coverage of Hurricane Helene and then roam widely, all in just 1,224 words, 4.5 minutes. 🎶 This week in 1991, A Tribe Called Quest released "The Low End Theory," a hip-hop masterpiece that provides today's intro tune... |

| |

| |

| 1 big thing: Historic Hurricane Helene slams Southeast |

| By Andrew Freedman |

| |

|

|

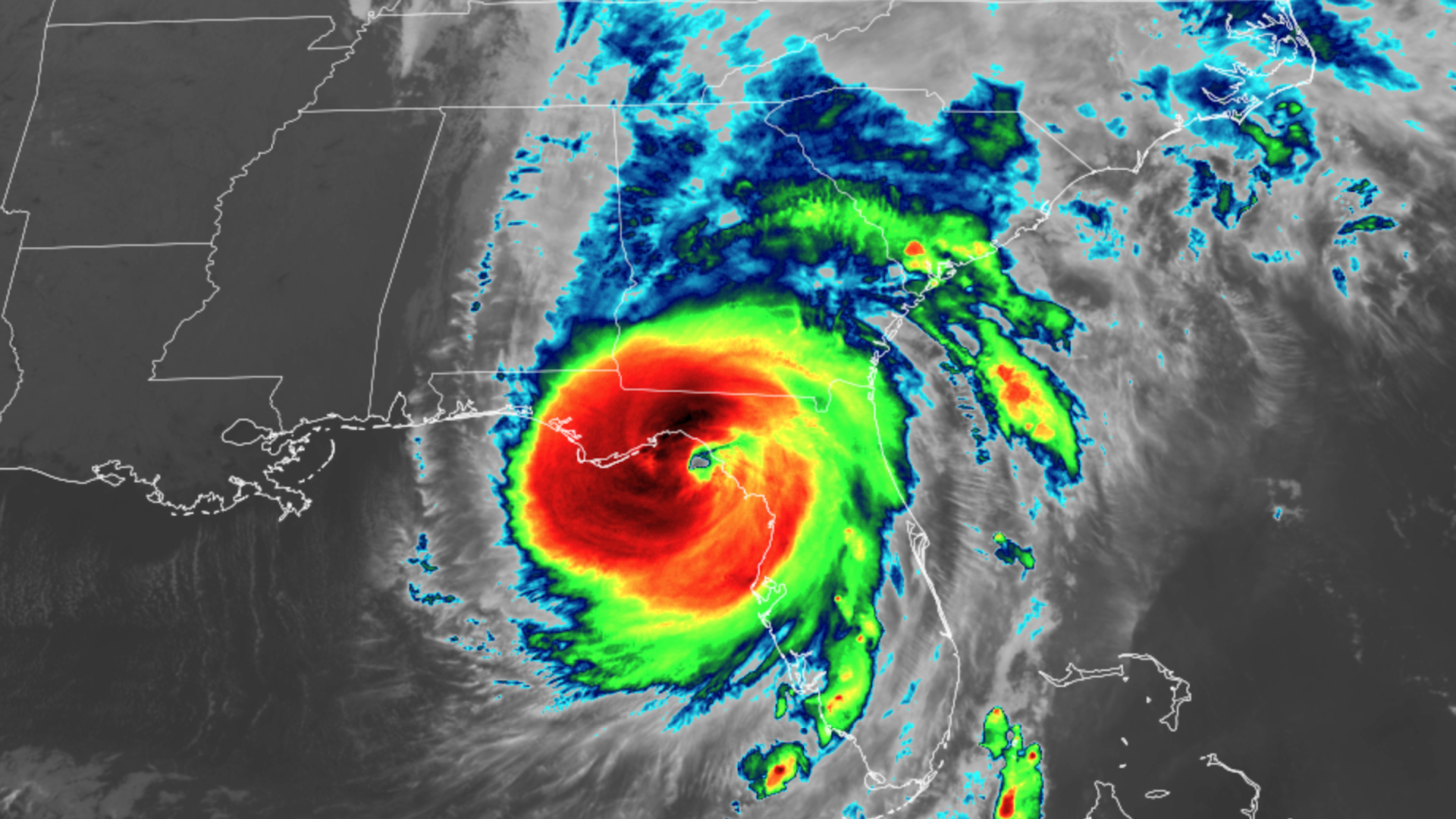

| Satellite image of Hurricane Helene as it made landfall in Florida's Big Bend region yesterday. Image: CIRA/RAMMB |

| |

| Hurricane Helene is one of the most expansive and damaging hurricanes on record for the Southeast, owing to its unusual size and rapid intensification. Threat level: As of this morning, more than 1 million customers were without power in Florida alone, with another 1.8 million in the dark in Georgia and the Carolinas. By the numbers: With 140 mph maximum sustained winds, Hurricane Helene was the strongest hurricane on record to make landfall in the Big Bend region of Florida, where the peninsula curves into the panhandle. - Images shared on social media showed a massive influx of storm surge, which was predicted to be up to 20 feet above ground level, inundating small communities such as Cedar Key, Fla.

Zoom in: Now a tropical storm, Helene's winds are forecast to continue to wind down as it moves further into north Georgia, but hurricane-force wind gusts are still likely in this region and the southern Appalachians. - Historic flooding is underway in western North Carolina and eastern Tennessee as heavy rains that preceded the storm combine with the hurricane's tropical rainfall to yield a high threat of landslides and flooding that could eclipse past events.

- The National Weather Service warned the storm would be "one of the most significant weather events to happen in the western portions of the area in the modern era." This includes Asheville, N.C.

Zoom out: Hurricane Helene started the day yesterday as a Category 1 storm and ended up 12 hours later as a Category 4 major hurricane. Context: Between 1982-2016 only six storms had displayed such a ramp up in intensity before a U.S. landfall. - Due to climate change, more storms now undergo rapid intensification, and there is an amplification of the intensification rates in the Atlantic Ocean basin.

- Climate change is also causing hurricanes to produce more rainfall than they used to a few decades ago.

- Hurricane Helene tapped energy from the hottest waters in the already record-hot Gulf of Mexico, known as the Loop Current. This is the same current of ultra-warm water that supercharged Hurricane Katrina in 2005.

Follow Axios Tampa Bay and Axios Atlanta's coverage. |

|

| |

| |

| 2. 🎭 Saudi psychodrama in oil markets |

| By Ben Geman |

| |

Data: Yahoo Finance; Chart: Axios Visuals The latest hints of the Saudi mindset — combined with signs of Libyan supply soon returning — are driving down oil prices. State of play: Analysts cited FT reporting that Saudi officials are "resigned to a period of lower oil prices" and preparing to raise output. - The Saudis are ditching an "unofficial price target" of $100 per barrel, the paper reported.

Why it matters: It's a sign that OPEC+ may proceed with adding barrels in December in a bid for more market share, despite weak demand signals from China and ample supplies. Between the lines: Getting a read on the Saudi posture is often tricky, which is why the FT piece traveled so widely. - Two good oil experts I touched base with don't think there was a $100 target (I don't mean any shade at the FT, which has awesome energy reporting).

"$85 [per barrel] is probably a good sweet spot for them, because it's a very good profit for Aramco but it's not too high that you see demand destruction," Saudi expert Ellen Wald tells me via email. What we're watching: ClearView Energy Partners said OPEC+ could again delay increases given the meh demand picture. - "Absent a prolonged material supply disruption and/or stronger sanctions enforcement," a Dec. 1 meeting could yield a production target decrease, the firm said in a note.

|

|

| |

| |

| 3. 📢 Bonus petro-notes: Deals, deals, deals |

| By Ben Geman |

| |

| 💵 TotalEnergies is buying a 45% stake in Lewis Energy Group's gas holdings in Texas' Eagle Ford basin. - Why it matters: The French multinational giant said its second Texas shale gas deal this year will further strengthen its U.S. LNG business.

✅ Via Bloomberg, the FTC will allow Chevron to proceed with its $53 billion Hess acquisition — on the condition Hess chairman John Hess won't join the board. - Friction point: The blockbuster deal is still caught up in Exxon contesting Chevron getting Hess assets in Guyana.

🤝 Reuters reports that Validus Energy has a deal to buy Citizen Energy for $2 billion including debt. The shale consolidation wave rolls on. |

|

| |

| |

| A message from Chevron |

| Innovating at Anchor to produce previously inaccessible oil & natural gas |

| |

|

| |

| At our latest deepwater development, Anchor, Chevron is pioneering energy production at greater pressures — up to 20,000 psi — with the plan to deliver 300,000 net barrels of oil equivalent per day in the U.S. Gulf of Mexico by 2026. That's energy in progress. |

| |

| |

| 4. ☀️ Exclusive: Amazon expects to remain top renewables buyer |

| By Hope King |

| |

|

|

| Illustration: Rebecca Zisser / Axios |

| |

| Amazon CEO Andy Jassy expects the company to remain the world's largest renewable energy-buying company for "several years to come," he said yesterday. Why it matters: His comments — during a closed event in New York — signal that tech's outsized influence on green energy adoption will remain intact as AI reshapes demand for electricity and resources. - They also come less than a week after Microsoft announced a seismic 20-year power purchase agreement with Constellation Energy that's designed to revive a nuclear reactor at Pennsylvania's Three Mile Island.

Jassy at one point said that "nuclear is another really important strategy" in meeting the company's climate goals. - He noted Amazon's first nuclear agreement with Talen Energy to someday power an AWS data center campus in Pennsylvania.

Full story |

|

| |

| |

| 5. Zillow home listings to feature climate risk, insurance data |

| By Andrew Freedman |

| |

|

|

| Illustration: Natalie Peeples/Axios |

| |

| Mindful of increasing risks from extreme weather events such as hurricanes, Zillow will combine climate risk scores, interactive maps and insurance information on its home listings. Why it matters: This step unveiled yesterday gives prospective buyers their first combined look at climate risk info with home insurance recommendations. Threat level: Insurance prices are rising in many parts of the U.S., due partly to climate change-related trends in extreme weather events, like hurricanes in Florida and California wildfires. Zoom in: The climate risk information will come from the climate risk company First Street. It will include historical data on past climate events that affected the area where a property is located, such as flooding or wildfires. - It will also have scores on future risks to properties from floods, wildfires, high winds, extreme heat and poor air quality.

"Climate risks are now a critical factor in home buying decisions," said Zillow chief economist Skylar Olsen in a statement. The bottom line: Zillow's climate information will be especially comprehensive compared to its competitors, First Street founder and CEO Matthew Eby said. Full story |

|

| |

| |

| 6. 👀 One tech idea: stretching the solar clock |

| By Dan Primack |

| |

|

|

| Illustration: Lindsey Bailey/Axios |

| |

| Solar power has always had one pesky limitation: It needs daylight. But what if it didn't? State of play: That's the question being asked by Reflect Orbital, a startup that recently raised $6.5 million led by Sequoia Capital. The big idea: Build and deploy a low-orbit constellation of Mylar "mirrors" that would send sunlight to solar installations in places that are still 90 minutes before sunrise or 90 minutes after sunset. - Once low-light minutes are included, this could mean an extra four hours of power generation.

Full story |

|

| |

| |

| 7. 💵 Number of the day: $40 billion |

| By Ben Geman |

| |

| That's the scale of Colombia's plan to replace declining fossil export revenues after the nation ended oil exploration, environment minister Susana Muhamad tells Bloomberg. - The plan uses multilateral development banks, with the U.S. playing an "informal" coordinating role, and the role of private finance is unclear, they report.

|

|

| |

| |

| A message from Chevron |

| Innovating at Anchor to produce previously inaccessible oil & natural gas |

| |

|

| |

| At our latest deepwater development, Anchor, Chevron is pioneering energy production at greater pressures — up to 20,000 psi — with the plan to deliver 300,000 net barrels of oil equivalent per day in the U.S. Gulf of Mexico by 2026. That's energy in progress. |

| |

| 📨 Did a friend, colleague or even a frenemy send you this newsletter? Welcome, please sign up. 🙏 Thanks to Chris Speckhard and Chuck McCutcheon for edits to today's edition, along with the brilliant Axios Visuals team. |

| | Dive deeper into the future of energy | | |

0 comentários:

Postar um comentário